I’m a little late here relative to the rest of FinTwit but thought I should post some thoughts on the year that was. I skimped a little on this last year so I’m going back to the full format. I’ll give some general thoughts on performance then some highlights on each of the current names. For those unfamiliar with how I categorize my holdings, here’s a link to some of my philosophy where I outline that thinking.

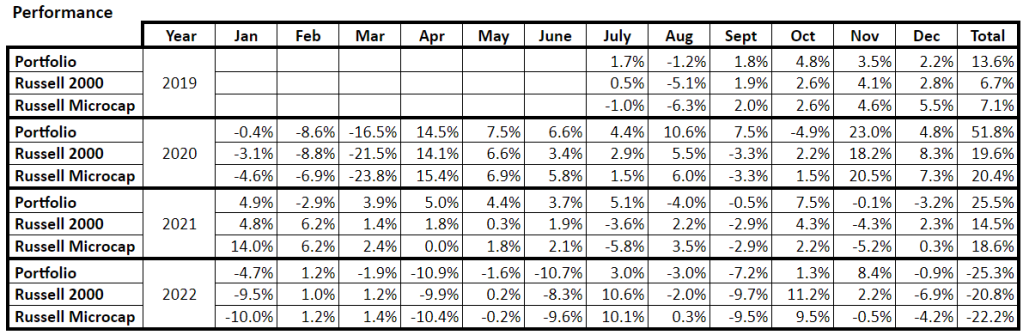

Performance for 2023 was satisfactory at +25% for the full year. Nothing stellar but still something to be proud of, I think. I’ve had a lot of thoughts around performance here toward the end of the year. I track performance relative to the Russell 2000 and Microcap indexes because that’s where I tend to traffic. And I’ve had little issue beating those indexes with some regularity (there’s a whole separate discussion around the flaws/issues with those, but I digress) as you can see from my performance table here. But I think the truth of the matter, which all of us from the smallest of individual investors to the largest of institutional asset managers face, is that we should all probably be measuring ourselves by the S&P 500. You can make whatever theoretical or academic arguments you want but the practical facts of the matter are that if you knew absolutely nothing about personal finance/investing and spent five minutes googling around to get even a basic understanding you would figure out that just slamming all of your savings into $SPY/$VOO/$IVV and letting it compound is about as good as anything else you could do. For us hobbyists (including myself here) the reality is that you can spend hours of your personal time doing painstaking fundamental/technical/quantitative research and breakeven or underperform the S&P all the same. Or you can do what everyone from total novices to the wisest of investors do: put it in the S&P and forget about it. Anyway, I bring all this up because my since inception performance still looks modestly favorable against the S&P (16.7% vs 13.1%), but if you throw out the outlier performance in 2020 when I happen to do >50%, I am actually underperforming it pretty significantly since the beginning of 2021. I can talk myself in circles with logic and rationale all I want, but the fact is for the last 3 years I would have been better off just parking my assets in the S&P and figuring out a better use of my time. I’m coming up on my 5yr anniversary of running the blog this year and will have a full 5yr track record to evaluate. Will probably write more about this issue then, but thought I would put some of that out in the open now.

In terms of portfolio activity, most of the year was “status quo”. Over the course of the year I added to every single name in the portfolio except for maybe two. Felt like I was able to do more research work this year than the last year or two, which was great. All the real activity was backloaded as I added a few small starter & special situations positions near the end of the year. As I say every year, I would really have liked to keep the blog itself more up to date but it’s hard finding the time to write between the day job and home life responsibilities. As always, I endeavor to be better in the new year – writing more and being more active on Twitter.

In the spirit of transparency I continue to add to assets to this managed account. Part of the reason for the high cash balance through most of the year is due to monthly inflows where I did not (and still don’t) have great use for the funds. But I do like to remind readers from time to time that the account that I track within this blog is the vast majority of my liquid net worth.

Successes:

My Canadian cornerstones Constellation Software ($CNSWF) and Terravest (TRRVF) had stellar years returning well over 50% each. Namsys ($NMYSF) and Dole ($DOLE) also had strong years at +30%. The showstopper was little Data Communications Management ($DCMDF) which announced a transformative acquisition early in the year and (despite well over doubling it’s share price at points in the year) finished up ~90%.

On the special situations side of the portfolio the Activision ($ATVI) deal closing was a good win that was sized decently. I nearly bottom ticked it in fall of 2022 when chances of the deal looked bleakest.

Failures:

Early in 2023 I finished closing out my position in West Virginian bank MVB ($MVBF). I was originally interested in all the banking-adjacent services they were adding and was always a little uncomfortable with the actual bank aspect of the position. The early year bank failures got me nervous enough to get out of MVB but not before a solid impairment of my capital and a year and a half of wasted time. I have officially sworn of banks – too hard for me.

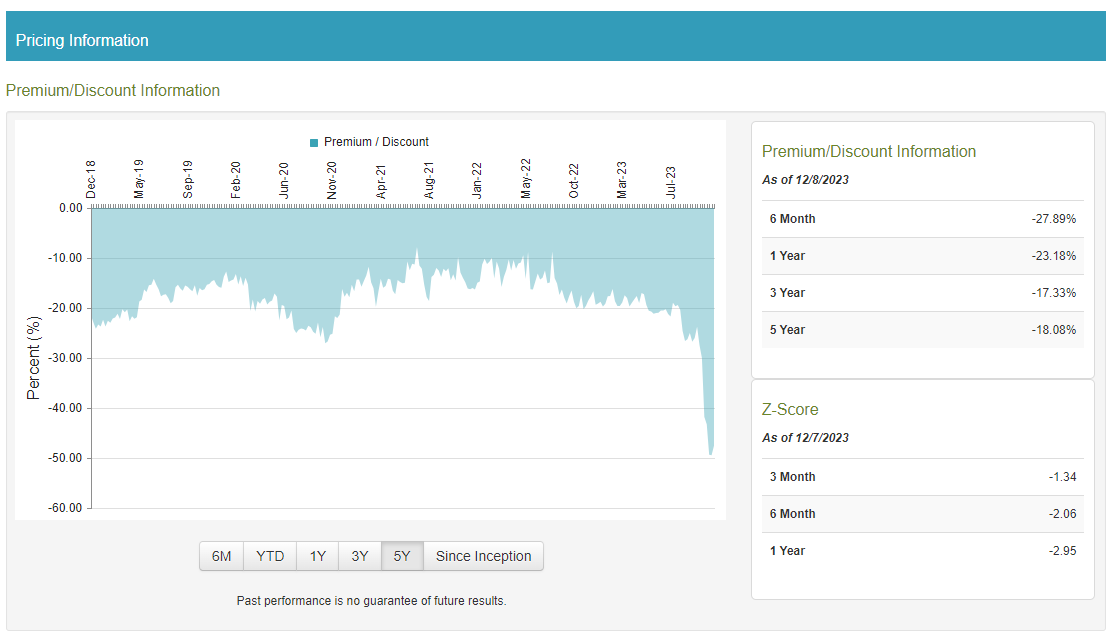

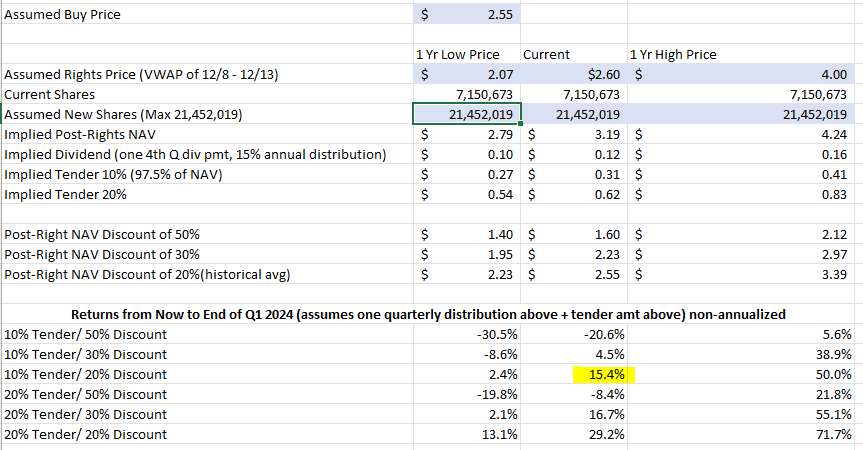

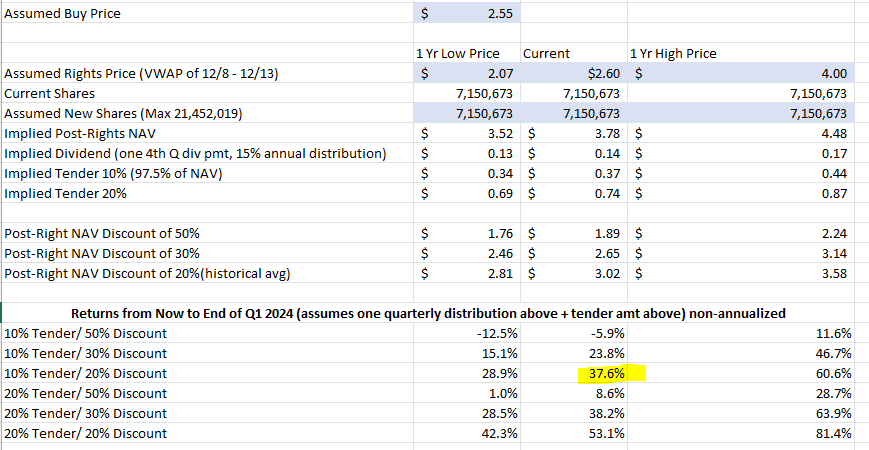

A small special situation that blew up in my face but luckily broke even was the Carlyle Credit Income Fund ($CCIF), a closed end fund that I bought into in January when it was still called the Vertical Capital Income Fund ($VCIF). Carlyle, the well-known global PE firm, had come in and acquired the public shell of this sleepy little RE debt CEF in order to change the investment objective and begin managing/raising capital for themselves. It was supposed to be a quick closing of the NAV discount by liquidating existing assets and Carlyle was going to throw in a special dividend kicker to make sure the vote to transfer control went smoothly. All went according to plan except the fund took a mysterious 17% haircut on asset sales against a recently stated NAV right as the old management was on the way out. Again, I more or less broke even on a 8 month hold but it’s frustrating to get screwed on the way out like that.

By far the biggest failure for me of the year was a missed opportunity on TravelCenters of America ($TA), a network of truckstops scattered throughout the U.S. which was acquired by BP in the summer. I kicked the tires on this thing from early 2022 up until just a few weeks before the deal announcement but could never quite pull the trigger. The value was pretty obvious at the time (and even moreso in retrospect). They were sitting on a ton of assets, a decent brand, and non-market leading but still respectable position in their industry. I was worried about their capex spend as they were going to embark on refreshing a number of their older locations and opening a few new ones in the midst of pretty high inflation and still struggling supply chains. I’ve been kicking myslef since this deal got announced – would have been an easy double in about a year if I’d have bought the first time I looked at it.

Current Holdings (as of 1/31/24)

As I’ve done the in years past, I thought I would give a quick update/thoughts on each of the current names in the portfolio. I have segmented them into the respective mental “buckets” in which I classify them (more on that philosophy here):

Special Situations (target % = 10-20% of portfolio, current % = 3% of portfolio):

Saker Aviation Services (SKAS, 1% of portfolio): Saker is a weird little nanocap that has no business being a publicly traded company. I opened the position late in December 2023 when it was trading below cash on the balance sheet. They operate the only helipad in New York City that is authorized for tourist flights (and used to operate a small regional airport in Kansas until they solid it a while back). Their license to operate the helipad has been continuously been re-granted by the city of NY for a number of years but now the city is in the middle of an RFP for a new operator who will also invest in some additional infrastructure. Based on what I can tell Saker is done and heading for liquidation (not officially, yet, just my conjecture). May still be a last puff in this cigar butt until the RFP is done but downside feels pretty solid here.

Sunlink Health Systems (SSY, 2%): Another bizarre nanocap that seems to be an amalgamation of assets. This one caught my eye when they announced they were selling a hospital facility in Mississippi for more than their entire market cap. That deal seems to have fallen through somewhat as the sale price has somehow gone from $8M to $2.5M or so. Sunlink also has some cash on the balance sheet, owns a small chain of pharamacies in Louisiana, and runs a healthcare IT subsidiary. Management seems to be riding this thing into the ground and sucking a lot of comp out of it but there might be something here.

Mean Reversion/Deep Value (target % = 40-60%, current % = 53%):

Namsys (NMYSF, 5%): Namsys is a steady little Canadian software company that builds products for armored car and “smart safe” users (think banks & Brink’s/Garda). I’ve been a holder since 2019 and after a few quite years where they struggled to resume sales traction during and post-COVID it seems like they are starting to show signs of life. They announced in 2023 that they would devote some of their excessive idle cash balance (usually somewhere between 20-30% of their market cap) on buybacks which was a positive development. I continue to think they are undervalued and could see either 1) resumption of topline growth that re-ignites interest in them or 2) an acquisition/merger by a larger player being strong possibilities in 2024.

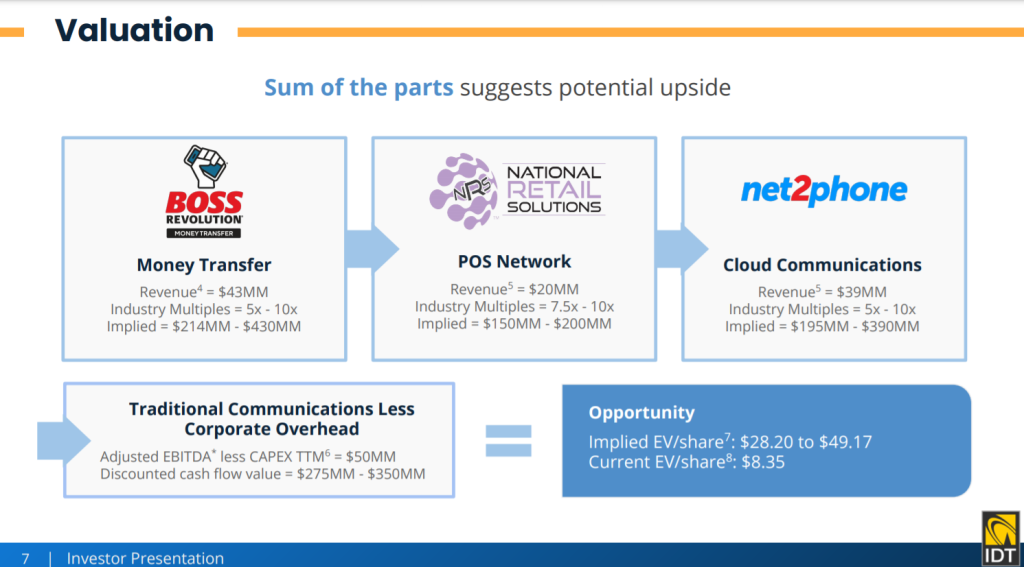

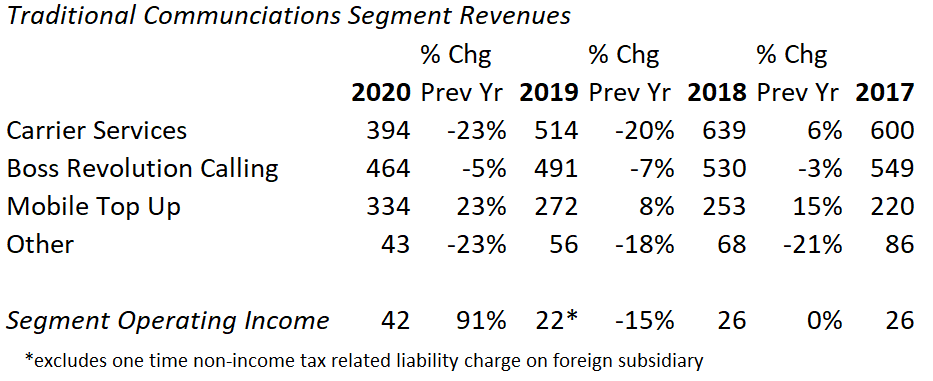

IDT (IDT, 21%): 2023 was a big year for IDT. Share performance was fine (+21%) and underlying fundamental performance still continues to be good to excellent. Net2Phone and the Boss ecosystem seem to be progressing nicely. NRS is still the crown jewel and continues to be the single most exciting aspect of IDT. NRS is probably nearing IDT’s market cap in worth – everything else is kind of thrown in for free. But I think the biggest development was the conclusion of the StraightPath litigation. In one of the more bizarre legal opinions I’ve ever seen IDT was let off the hook. That helps clear up what is already kind of a complicated SOTP story and will hopefully attract more investors to the name. I’m also hopeful that we will get some news about the Net2Phone spin this year. But all in all 2023 was pretty good to IDT and I was happy to add to the position in the later half of the year. I still continue to believe in it (obviously, as it is my largest position by far).

Yellow Media (YLWDF, 7%): Another year, another big repurchase of shares for Yellow. Results for 2023 were a little lackluster as the stability in revenues and profitability declines worsened. Yellow has and will continue to be a terminal value problem until they can prove some stemming of the deterioration. It’s still pretty cheap but focused on returning cash to shareholders. I added to the position a bit over the course of the year but I am a little hesitant to make this a much bigger position at this point.

Data Communications Management (DCMDF, 9%): 2023 was a big year for DCM with the acquisition of the RRD Canada business. At one point in the year the stock was well over a double. After the deal early in the year it was mostly about integrating and hitting their synergy targets, which seems to be on track. The stock is getting some credit for the good deal but is going to have to prove on the delivery. I continue to think it’s cheap (as outlined in my most recent write up) and believe in the company & management. Would consider adding on any weakness in the price this year and an comfortable with it being my second largest holding.

Dole (DOLE, 7%): To be honest Dole has been a bit of a disappointment. Throughout my holding period the company has struggled with its Fresh Vegetable division (which it is in the midst of divesting), global weather has been a concern, and rising costs have been a headwind. It has also lost a little of the “special situations” luster (I.e. U.S. listing mid-merger) as well. Holding for now but not actively planning on adding to this one. I would like to see how the financials start to look once Fresh Veg is out and might start to look for an exit here.

Medical Facilities Corp (MFCSF, 2%): Medical Facilites is a relatively new add during Q4 of 2023. It’s a bit of a turnaround that owns and operates several regional surgical centers and has recently re-focused on shareholder value, as outlined in several wonderful writeups from others. Scaling down is not really sexy to the market and there’s some weird structural quirks going on here with the split ownership on the hospitals, so it’s easy to see why the mispricing is there but I think management understands this and is moving to fix it. Started this off pretty small but could see myself adding here as time goes on. Looks very cheap with a fairly reliable business & asset base.

Redishred (RDCPF, 2%): Redishred is also a newer holding from Q4. It’s a rollup of document shredding businesses across the U.S. that began life under a franchisor model. Over time they’ve begun buying out the franchisees (and generally improving their underlying economics as a result) and adding in smaller opportunistic tuck-in acquisitions around their main hubs. The business is somewhat capital intensive but I think that actually works in their favor when it comes to consolidating established sub-scale players. And they seem to have a bit of a different focus than larger players in the document management/disposal space. I think a number of factors are creating a mispricing here: the market cap (<$50M), Canadian listing despite the U.S. operations, leverage (~2-3x debt/EBITDA) and a misunderstanding of the business (high variance in their recycling revenues due to fluctuations in commodity paper pricing). Have already added to this in 2024, will probably continue to add more.

Long Term Value (target % = 40-60%, current % = 27%):

Constellation Software/Topicus/Lumine (CNSWF/TOITF/LMGIF, 5%): Same old same old with the CSU machine. I keep looking for a spot to add to CSU itself as well as Topicus & Lumine, but there’s not really been any great times to take advantage of soft pricing. Have not devoted nearly enough time to digging into the spinouts but hoping to remedy that sometime soon.

Terravest (TRRVF, 9%): Terravest continues to execute exactly to plan. Have been pleased with their deal activity post-COVID. With the benefit of writing this a month and a half into 2024, it’s already shaping up to be another great year for this little gem. Starting to get a lot more attention on Fintwit (and hopefully in the real world now that they are in the $1B market cap range) and still looking pretty cheap.

Dream Unlimited (DRUNF, 7%): Dream had a decent 2023, all things considered. But I’d be lying if I said that I hadn’t had some anxiety about the rates, rising costs, and liquidity concerns facing everyone in the real estate space over the last year or two. I did hold my nose and add a bit through 2023. In the very long term I still feel solid about what DRM is doing and the quality of it’s assets and organization but I’m not nearly smart enough to be slamming a ton of capital in here.

IAC (IAC, 6%): IAC is the one name in this bucket that I have seriously considered bailing on and, given an appropriate exit price window, I would probably move on from in the near future. But every time I run my sum of the parts numbers here the valuations are just too compelling. Assuming markets in 2024 carry through with some of the momentum we saw in late 2023, we might start to approach a reasonable valuation here. I still continue to believe in value creation happening at IAC between the team, mission, and execution but I’m starting to understand the time to buy something like IAC is right after one of the big spins (my initial purchase was right on the heels of the MTCH spin) but you have to be smart about when the valuation peaks out. When you hit a big dry spell like what I’ve held through, where there’s no big value catalyst, it just trades at a perpetual discount. And as much as I like the team here it’s possible that the way they’ve handled the Angi part of their business hasn’t been ideal – it’s largely swamped the rest of the good work they are doing elsewhere.

Thanks again for following along for another great year. As always, you can find me on Twitter. Please feel free to reach out.