Greetings to all and Happy New Year! As I have done in years past, I’ve compiled some high level observations as well as a more comprehensive holdings review below.

This is, unfortunately, becoming a mainstay in these annual portfolio reviews but I’d like to acknowledge that my writing output on the blog has been pathetic this year. As ever, I hope to improve this in 2023 and look forward to the changing of the calendar as a fresh start in which to deliver on this goal. Whoever you are and however you have found this blog, thank you for taking the time to read it. I endeavor to be a better writer and investor in the new year.

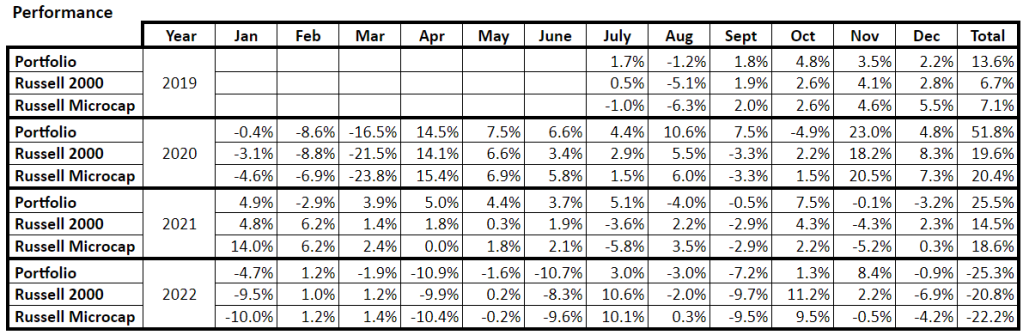

To be honest, overall portfolio performance was somewhat disappointing this year. The portfolio was down about 25% over the course of the year vs. -21% and -22% for the Russell 2000 & Microcap. While not wildly off the mark, this was the first calendar year of underperformance against my benchmarks in the short life of this blog/portfolio. Optically, full year performance was uncomfortably close to the benchmarks, although month by month performance was less correlated which makes me feel better. (Long time readers may remember that I take pride in looking different from the benchmarks)

It was a very quiet year in terms of portfolio activity. I exited two positions (GRVY, RBCN), added to a few current holdings (IDT, NMYSF, YLWDF), and added two merger arb names (ATVI, TGNA). Although I added substantially to the existing names, there were no new meaningful additions to the portfolio this year. The market volatility this year was odd in that I felt comfortable with adding to existing holdings but found little else of interest that offered obvious value. Things have, without a doubt, gotten cheaper but I find that I am having trouble pulling the trigger on much of anything. Interestingly, my research output was wider in scope but shallower than in previous years – i.e. I investigated many more new names than usual but did not dig as deep on them.

In looking at the full year performance for the individual portfolio holdings, one thing I noticed is that my smaller (by market cap) names held up better than my larger names. DCM, Yellow Pages, TerraVest, and NamSys were among the best performers and all are <$400m or so in market cap. Which isn’t to say the rest of the portfolio is composed of behemoths by any stretch of the imagination: IAC is now < $5B and only Constellation is above $10B (among the non-arbitrage holdings). As I look at the portfolio and continue to research new names I find myself gravitating toward even smaller candidates in search of simpler businesses/situations that offer that small/micro information asymmetry opportunity.

| Name | Ticker | 2022 Performance (%) |

| Rubicon Technology Inc | RBCN | 42.03 |

| Tegna Inc* | TGNA | 16.22 |

| Activision Blizzard Inc* | ATVI | 15.77 |

| DATA Communications Management Corp | DCMDF | 4.12 |

| Yellow Pages Ltd | YLWDF | -2.68 |

| TerraVest Industries Inc | TRRVF | -6.68 |

| NamSys Inc | NMYSF | -9.87 |

| Constellation Software Inc | CNSWF | -15.99 |

| Dole PLC | DOLE | -25.15 |

| IDT Corp Class B | IDT | -36.21 |

| DREAM Unlimited Corp | DRUNF | -38.20 |

| Topicus com Inc | TOITF | -44.39 |

| MVB Financial Corp | MVBF | -45.33 |

| IAC Inc | IAC | -66.03 |

| Vimeo Inc | VMEO | -80.90 |

Successes

As you might imagine in a year like this, there is not a ton to discuss in the way of positives. About the only bright spot this year was the exit of Rubicon Technologies (RBCN). RBCN was a small net-net name that I originally added in late 2020 based on the thesis that it was a controlled liquidation/deep value sort of a situation with some smart & trustworthy players involved. Well the value finally materialized this year when Janel Corp (JANL) tendered for 45% of the shares (presumably with the intention to later take a controlling stake and monetize the tax assets at RBCN). For me, the tender was a great opportunity to exit at ~90% gain at a < 2 year holding period. In retrospect, I could have juiced it a few percent more if I had played the timing just right between the tender and special dividend (I exited just before the tender date) but I was happy with the outcome nonetheless- I just wish the position had been larger!

Besides RBCN, I was enthused to see the smaller and more ignored micro-cap names in the portfolio hold up well while continuing to make progress in the underlying businesses. Falling markets and scarce bids can be a scary time for low float stocks but I was happy to see some of my fellow shareholders in these names stay the course.

Failures

Readers may recall my tumultuous relationship with South Korean game developer Gravity (GRVY) from previous blog entries. Well, 2022 finally saw the end of that relationship as I completely exited the last of my position in May. It’s hard to call a position in which you make money a failure, but between all the buying/selling & what could have been (shares peaked above $200 in early 2021 while my average exit price was just ~$60) it’s been a frustrating situation that resulted in returns well below my target hurdle rate. Not to mention I think there is still a ton of value here between the franchise quality, strong balance sheet, etc. But ultimately, I concluded that it is a captured (by parent GungHo) and ignored foreign small cap that has low probability of unlocking said value anytime soon. For me, this one was more a waste of time and opportunity cost than anything.

MVB Financial (MVBF), although not fully liquidated yet, will go down as a swing and a miss for me as well. I tried to get outside of my comfort zone with this name but ultimately I don’t think I have the conviction to see it through. See further discussion below.

I imagine that as we distance ourselves further from 2022 my failures this year will be those of omission rather than commission. As discussed above I was relatively inactive this year despite many names getting significantly cheaper. I suspect in the future there will be several names that looked inordinately cheap at the time that I was unable or unwilling to take advantage of.

Current Holdings

Special Situations (target % = 10-20%, current % = 4%):

Activision Blizzard (ATVI, 3% of portfolio)

I never got around to writing up ATVI (or TGNA below) but chances are you are well aware of the situation here. The market is largely worried about regulatory interference here – and there has been a ton of press to warrant that I suppose – but I am a firm believer that the path of least resistance for all deals of this magnitude (excluding utilities and high profile targets) is to close successfully. Furthermore, I don’t think Microsoft would have engaged ATVI and risked endangering their relatively clean anti-trust profile (post-1990s browser monopoly case) if they weren’t pretty certain they could close this deal. As I write this, the spread is still juicy at >20% with what I expect to be a 2023 close date – so quite compelling IMO.

Tegna (TGNA, 1%)

Tegna is mid-sized media company that primarily owns/operates television stations (60 or so). Early in 2022 TGNA announced it had come to terms with Standard General and Apollo with a few assets being carved off for Cox Media Group. SG is a hedge fund/PE outfit with extensive experience in both media and undervalued assets. Apollo is Apollo, and CMG is there to solve some anti-trust issues (from what I can tell). There will be headlines and hand wringing but here again I see a deal that finds a way to close. Regardless, TGNA seems modestly valued (especially relative to peers) and reading through the deal documents suggests there are a number of other potential suitors if this particular set of buyers falls through. Current spread is roughly 15% for a deal that has every incentive to get done as quickly as possible.

Mean Reversion/Deep Value (target % = 40-60%, current % = 59%):

IDT (IDT, 28%)

I have to admit, I’ve never been excited to hold a name that’s down almost 60% from its peak – but here we are with IDT. Despite being down almost 40% on the year and (correctly) scuttling their Net2Phone spin in 2022, it was a really strong year for the company. The traditional communications business came back to Earth after some COVID tailwinds, but continues to be a cash machine. The emerging parts of the business like Net2Phone, Boss Money, and NRS continue to make moderate to stellar progress within their domains. NRS continues to look like a gem of a business to me. I come away from each and every one of their earnings calls more excited than the last. I increased my shares by about 50% over the course of the year, keeping it at about 30% of the portfolio throughout.

Dole PLC (DOLE, 9%)

Dole has had a tough year given the macro environment, but has delivered results roughly in line with or ahead of peers. I continue to think it is undervalued and overlooked with a strong competitive position. If I’m being perfectly honest with myself, I probably got too big too quickly in the position. It was a low double-digit position heading into 2022 and being overly aggressive so early on has left me hesitant to commit more capital as it has drawn down.

Data Communications Management (DCMDF, 9%)

DCM is a name that I am committing to writing up soon. 2022 was a great year for the share price and honestly a pretty good year for the fundamental business. Revenues saw strong growth on new business & some initial roll outs of their “tech-enabled” subscription services. Margin and EBITDA growth were also very good as costs came down with continued rationalization of resources. I think the low hanging fruit has probably been harvested (i.e. cost cuts, headcount reduction, facility consolidation) so 2023 will probably be a real test of their new strategy validity, especially if the business environment slows amidst a recession.

Namsys (NMYSF, 5%)

It was a pretty ho-hum year for NamSys. Early year revenue growth was mid-single digit YoY but there was a decent spike up in their CY Q3 results to ~10% YoY – some of that is likely currency fluctuation as they transact most of their business in USD but report in CAD. In general I was hoping to see more development in the financials as they continually point toward the return of conferences/industry trade shows in 2022 and beyond as big marketing events for them. I presumed some of that would kick back in during the year, but some of their commentary suggests it may now be 2023 before those get into full force. On the positive side, they mentioned exploring new verticals with similar logistical challenges like the traditional CIT business lines they currently serve. Nonetheless, the company is still sitting on 20% of their market cap in cash, no debt, and valued sub 10x EV/EBITDA. Still an attractive set up for a solid little business.

Yellow Media (YLWDF, 5%)

Despite a pretty volatile path, share prices ended roughly where they began 2022 for Yellow. Along the way the company paid ~4% in dividends and repurchased roughly a third of their shares outstanding. They still carry ~$40M in cash on the B/S (15% of market cap) and have been debt free for over a year. Revenues continue to decline but the rate of change has continued to slow over the last 2 years. And I continue to have confidence that management has a sober perspective on the profile and prospects of the business. Yellow still trades at ~3x current cash flow – I understand most investors ignoring a clearly declining business but the value here is too attractive to pass up IMO. Unfortunately, I got too cute when the pro-rata repurchase happened and did not reinvest my proceeds back at the depressed price level in October. However, I think there may be an opportunity to add at attractive prices early in 2023 as one of the majority shareholders has filed to sell roughly half of their position.

MVB Financial (MVBF, 3%)

Late in 2022 I began liquidating my position in MVB. I plan to sell of the rest of the shares in early 2023. All the reasons that drew me to MVB in the first place (new, tangentially-banking-related business lines aimed at creating diversified growth) are still present but I have gotten too uncomfortable with the core banking business. This was the first true bank/financial that I’d dabbled in and, as much as I tried to get myself comfortable with those risks/industry dynamics, I never felt at ease with the foundations of the business. To be honest, all the crypto/fintech related blow ups elsewhere in the markets has spooked me over the edge. MVB is just a little too close to those elements for my comfort. I am totally prepared to look like an imbecile here as I think there is still plenty to love about MVB but I think this comes down to a bad fit as a holding for me personally.

Long Term Value (target % = 40-60%, current % = 25%):

Dream Unlimited (DRUNF, 8%)

Shares were down pretty significantly for Dream in 2022 as the Canadian real estate market begins to reconcile with a higher interest rate environment. Undoubtedly, that will have some impact on Dream’s direct and indirect holdings in the short to intermediate term. But there’s also plenty to be excited about as Dream continues to have great success gathering new assets. As of the Q3 reporting, they’d added >$2B in new fee earning AUM. Other big developments in 2022 included launching a residential REIT vehicle, a joint venture with a sovereign wealth fund, and a joint buyout of Summit Industrial REIT. I do worry about the macro real estate environment and expect the short term might be bumpy, but I think there are plenty of signs of success here and a competent management team to see them through.

TerraVest Industries (TRRVF, 8%)

I’m not going to pretend to know enough about the natural gas market, Canadian-specific LPG/NGL supply & demand dynamics, or western Canada O&G processing equipment utilization to speculate on whether TerraVest moderately or drastically over-earned in 2022. What I am willing to say is that they had a strong year from a strategy execution perspective. I mentioned last year that I was somewhat disappointed that they were not scooping up deals post-COVID. Well, this year was much better on the M&A front as they closed 3 deals (on the heels of one near the end of Q3 2021). Metrics up and down the income statement were all up significantly on the year while shares were relatively unchanged. Given that I believe they have materially added to their earning power this year (and with some near term upside optionality assuming we may see a shift in the energy regime), I think their low absolute valuation (10x P/E, 9x EV/Adj EBITDA as I write this) continues to misconstrue the underlying value here. The only element that gives me pause here is the debt growth. Term debt is up 50% YoY and financing costs have risen dramatically. They are pretty levered relative to cash flows at this point, so I think that eventually will weigh on their ability to do deals (although to be fair their deals skew small).

Constellation Software/Topicus (CNSWF/TOITF, 7%)

Shares were down for Constellation/Topicus this year, but by all accounts, the businesses are chugging along as always. This was a big year for capital deployment back the mothership CSU – I’ve seen ~$1.7B in new acquisition spending quoted, which would be the most they’ve ever done. It also looks like there will be another spin off in conjunction with an acquisition of WideOribit & merger with the existing Lumine group. I continue to be a long-term holder and look forward to what Leonard & company have in store.

IAC/Vimeo (IAC/VMEO, 2%)

It was a very tough year for IAC. Shares were crushed along with other tech/venture-oriented names. ANGI got absolutely smoked and MGM was down >25% on the year, so even the look through names got blasted. The integration of Meredith seems to be moving pretty slowly and with some material bumps along the way. Turo filed an S-1 which could catalyze some value short term, but we’re not exactly in a hospitable IPO environment. Digital advertising spend in general took a noticeable step back, which impacted some of their other businesses. However… I still see a ton of value here relative to the share price. Excluding the look through ANGI & MGM interests the rest of the businesses are trading at ~$1B in market cap. I get that IAC is out of favor at the moment, but I continue to see compelling value and a talented/competent management team with a long term perspective. To be honest, I should have been adding to it on the way down this year but I’ve been trying to find the bottom. I think we are close and I expect to be adding early in 2023.

Names of Interest

I haven’t done this in previous years, but I’m going to include a few names below that I have done some work on at some point this year that never materialized in the portfolio (but still may!). I’d be interested in hearing from you if you’ve done any work on the names. Or perhaps this could serve as a jumping off point for you to do some work if your interest is sufficiently piqued.

Sally Beauty Holdings (SBH) – Sally is a retail chain of cosmetics/beauty products. Think poor man’s Ulta with more of a focus on hair products and “professional” retail (i.e. independents & salons). I liked the steadiness of demand for their products with some upside potential for a post-COVID bump as people continued to ramp up in person events. It looked cheap over the course of 2022 but I ultimately passed. There’s a lot of debt here, they are actively cost controlling/shrinking the store footprint, they’re pretty clearly behind on their digital offerings, etc.

TravelCenters of America (TA) – TA operates just under 300 travel centers (i.e. fueling & service stations mostly aimed at truckers but increasingly standard passenger vehicle traffic) across the U.S. The industry is fairly small for these niche stations and TA is a distant 3rd. A new management team took over and is in the downslope of a big transformational turnaround plan. Similar to SBH I like the simplicity and resiliency of the business but I had some hesitations about the leverage, capex plan in this environment (they are rehabbing many under-maintained locations at a time where labor and materials are scarce and expensive), and strategy moving forward (they’ve introduced a franchise model but have been very slow rolling those locations out). I thought there was a lot to like here but the downside profile gave me enough pause to pass. I will likely keep an eye on this one.

Brilliant Earth Group (BRLT) – Brilliant Earth is a small-scale retail jewelry concept (in the vein of the Signet brands) with a bespoke/high fashion spin. BRLT has ~30 showrooms across major metros in the U.S. where they sell mostly custom (but some off-the-shelf type products) jewelry with a high-touch service model. They offer primarily appointment-only “jewelry consultations” with an emphasis on personalization and ESG awareness around their products. They describe their model as asset light (they hold little inventory as most pieces are built by the customer with custom components/combinations) and agile (reduction in obsolete inventory as tastes change & they proclaim to be data/analytics driven on consumer behavior). To be honest, the business model is the most interesting part here – I think there is some strong potential in the concept. The stock, however, is kind of a mess. It’s a busted SPAC that’s down >70% from the combination merger, the financials are typical of a firm squarely in “growth at all costs” mode, and as much as I like the concept I don’t know that its fully proven yet. This is a name I will probably keep an eye on, but just can’t get comfortable with at this point.

Conclusion

There you have it. Thank you for reading this far and I hope you found something useful in here. Here’s to a great 2023 for us all (and hopefully a few more blog posts from yours truly)!

Sawbuckd