DCM is Canadian print services provider undergoing major changes to its business model and working to integrate a transformative acquisition while being somewhat underpriced by the market due to perceived industry headwinds and historical reputation for middling operational results.

The Numbers (as of 12/13/23):

Price DCM.TO C$2.55

Mkt Cap C$140M

EV C$386M

EV/EBITDA (LTM) 10.8x

The Company:

Data Communications Management (DCM) is an established and successful print services provider undergoing significant organizational changes in an effort to pivot toward a technology “platform” business model. The legacy (and so far still the core) business is highly customized, complex spec’d outsourced printing services for large enterprises. Like most print service providers this includes the design and printing of direct mail, letterheads, envelopes, forms, labels, etc. Their newer business initiatives are really an extension of the old core business. Their DCMFlex product is a workflow management platform that allows users to find, customize, and order branded template materials within their organization. ASMBL is a newly launched digital asset management platform that integrates further upstream within clients’ existing marketing workflows. They also have a suite of other offerings around marketing campaign management, personalized video, and regulatory-mandated communications.

One recent change at DCM has been the acquisition of a major competitor – the Canadian print services operations of RR Donnelly (RRD). DCM announced the deal in February of this year and closed the transaction for C$135M in April. The acquisition will be significant to the business, nearly doubling revenues (~C$250M annual revenues from RRD Canada) and headcount while providing access to ~400 net new clients. DCM has called out opportunities for gross margin improvement and have identified C$30-35M in targeted cost savings through integration. The deal comes on the heels of the broader RRD business being taken private by PE firm Chatham Asset Management in late 2021. In addition to the obvious benefits of new customers and additional resources, the sale from Chatham also suggests the newly acquired business may have been seen as non-core and therefore neglected or potentially under-invested.

Post-acquisition DCM will serve nearly 3,000 clients across a variety of industries in Canada including major banks, insurance companies, national retailers, government agencies, healthcare service providers, energy & utility companies, etc. Revenues are derived from 1-5 year service contracts that generally contain volume, raw material cost, and inflation pricing adjustment clauses. Pre-acquisition DCM boasted of >95% retention rates and claimed to work with 70 of the 100 largest Canadian companies.

Another major change at DCM was the arrival of current CEO Richard Kellam. Kellam was appointed CEO in early 2021 and brought to the role 35 years of extensive international business experience from stops at Goodyear, Mars, Wrigley, and Playtex in addition to CEO experience at Advantage Group International (a consulting/business development organization working with international consumer goods & retail brands). Kellam initially found DCM through a consulting engagement with the company and was enticed enough with the business and opportunity to come aboard as CEO in a time of post-COVID upheaval at the company. Since his arrival, Kellam has demonstrated notable business acumen and leadership by rationalizing business operations and completely refocusing a sleepy ho-hum printing business around what he calls a “print-first to digital-first” transformation initiative. To boil the DCM thesis down to its simplest terms, Kellam is engineering a transformation from a high-competition, low value-add business (customized printing) to a significantly more valuable business via upstream software product integration. The phrase “platform business” is cliched at this point, but ultimately that is the objective at DCM – moving from a simple service provider to a wholistic digital-to-print solution for clients with complex needs.

The Good:

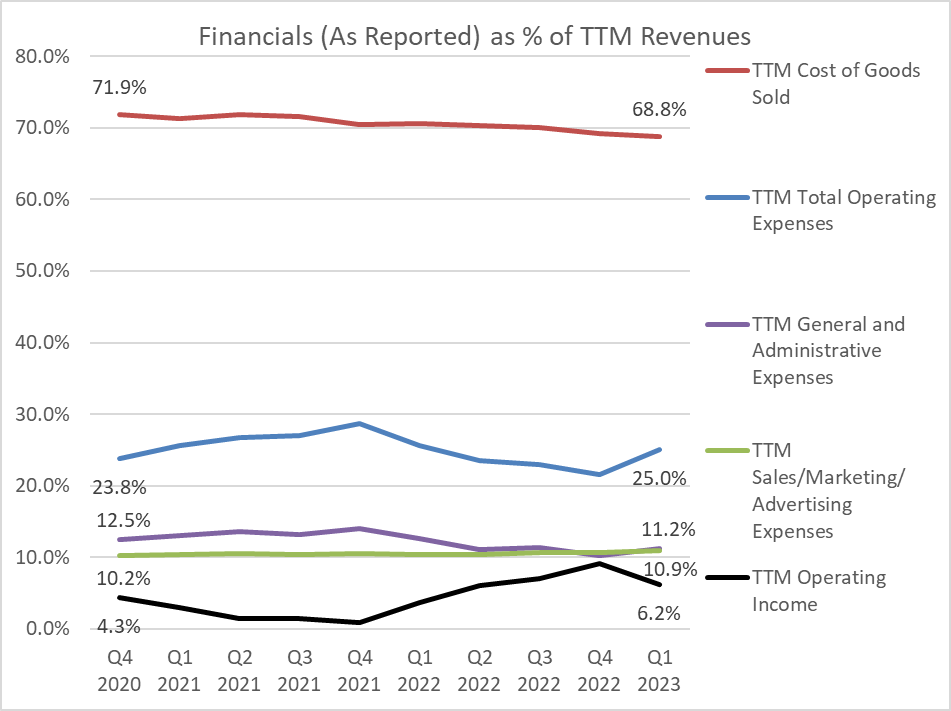

Having been a shareholder of DCM for some time now, I have been impressed with management – particularly Kellam. Since his arrival in Q1 2021, DCM has gathered significant operational momentum and appears to be aligned under a reasonable and potentially underappreciated new strategy (as discussed above). Phase one of this pivot has been a rationalization of the legacy business. Through Q1 2023, Kellam and DCM have reduced bloated headcount by >15%, consolidated operating facilities, focused on increased operating efficiencies in production and billing/collections practices, and reduced net debt by about a third (C$96M in Q4 2020 to C$59M in Q1 2023). Over the course of Kellam’s tenure from Q1 2021 through Q1 2023, the numbers are not necessarily “blow you away” improved but are certainly impressive within the broader context of the inflationary environment and volatile business landscape. You can see the incremental progress in the metrics shown below (displayed as a percentage of TTM Revenues, beginning Q4 2020 which was one Q before Kellam’s appointment as CEO). Most expenses are down marginally over this time frame while operating income is on a nice upward trend.

What’s more encouraging is that the slight uptick in Total Expenses and corresponding downtick in Operating Income in Q1 2023 was the result of one-time charges related to the aforementioned RRD acquisition. Adjusted for this extra expense the Q1 2023 TTM Operating Margin would have been 8.3%, well over double where margins were in Kellam’s first quarter (Q1 2021) at the helm. It should also be noted that top line revenues were up ~15% over the time frame displayed above. I am not totally confident in assigning that success to DCM versus just chalking it up to lagging post-COVID normalization and/or contractual inflation adjustments baked into their service agreements. But, nevertheless, the improvement in dollar terms is quite meaningful as TTM operating income in Q1 2021 improved from C$7M to C$23M in Q1 2023 (adjusting out the RRD acquisition costs). Is DCM’s management team the greatest operators of our generation? Are two years of operating trends in a challenging business environment and an uncertain global macro backdrop unassailable proof of a sure fire turnaround? Certainly not. But I do think that the incremental improvements herein are in line with Kellam/management’s commentary and some credence should be given for a job (so far) well done.

I belabor the point around Kellam/management and their abilities because I think that it is the foundation for the forward looking investment case for DCM. I think you need to have some respect for management’s capabilities to optimize the newly acquired RRD operations in line with what they have done at DCM and continue to generate traction on their new offerings.

The new business initiatives are a little fuzzier in terms of progress. The Flex platform sounds to be the most mature offering. To expand on the description above, Flex is a software platform that allows the large, complex clients that DCM works with to manage their marketing workflow, content creation, regulatory compliance requirements, etc. across physical and digital channels while integrating directly with DCM’s manufacturing capabilities. Although DCM does not report segregated individual product revenues, management has pointed out that roughly 30% of revenues (as of mid-2021) were “tech-enabled” (with Flex being the backbone of this offering) and are targeting 75% by 2025. Granted, there is little visibility into the economics of Flex but management has specifically pointed to Flex as a “means of increasing gross margins” as they continue to roll it out to existing clients and onboard new prospects. Management has also alluded to the more “pure ARR” nature of four other nascent products (including ASMBL, a holistic “digital asset management” platform, and PRSNL, a customizable video delivery platform).

What might all this mean in actual economic terms? EBITDA margins for the 5 years pre-COVID (when the business was decidedly more focused on traditional print services) ranged from 5-7%. Calendar year 2022 saw full year EBITDA margins of 14% and management explicitly identified (pre-RRD acquisition) 5 year targeted EBITDA margins of 18-25%. Post-RRD acquisition, they seem to be backing off a bit identifying only >14% as their stated target. I think the low hanging fruit in terms of cost reductions at DCM has probably been harvested, but the new RRD operations may provide more runway yet. They have targeted C$30-35M in cost reductions as they integrate the operations and also identified some room for improvement on gross margins at RRD. Assuming all these costs savings fall to the bottom lines, we’re looking at C$70-75M in EBITDA in the relatively near future.

The large RRD acquisition did introduce a fair amount of debt into the capital structure as it was financed largely with new debt. DCM spent the last few years paying down old debt from ~C$150M in 2019 to ~C$59M in Q1 2023. Post-acquisition net debt now stands at C$246M (C$102M ex-lease liabilities, with an additional C$15M in asset sales under contract which will further pay down debt balances early in 2024) and management has communicated a target debt level of ~1x EBITDA . Despite the debt load, I believe that as the market understands the higher quality of the “new” DCM and they prove out their ability to move further up the value chain and become more embedded with their clients’ workflows via the platform offerings we should see multiple expansion to reflect the improving business quality. We’ve already seen an appetite and ability to pay down debt fairly quickly – I would expect the same in the future.

I’ve discussed Kellam’s leadership at length but I believe it is worth mentioning that he, as well as other insiders, have considerable alignment with shareholders. The collective value of RSUs, options, and shares purchased in the open market totals ~C$10M for Kellam. Cumulatively, insiders (many of which are, admittedly, former executives who acquired their shares during employment but remain involved on the board) own ~23% of shares.

The only other point I feel compelled to mention here is that DCM’s path seems pretty simple to me. Like basically any other business (especially mature small/micro caps) they are trying to build new offerings adjacent to their (successful) core legacy business. They have decades of experience and are moving further up the workflow with their existing customer base (and hopefully new ones). I really like companies that launch new/adjacent initiatives from a position of strength (I.e. a reliable core competency which provides stability as they incubate new offerings). For DCM, they have been in the printing business a long time and understand their customers’ challenges. Evidence suggests they have been successful in servicing those needs, as indicated by the size and quality of their customer base. They are probably the second largest printer services provider in Canada at this point and now have dynamic leadership at the helm. I think at the end of the day, at current valuations, you are paying for a solid (but not yet sexy) business that is underestimated by the market and has plenty of upside potential if they can execute according to plan.

The Bad:

To state the obvious, printing physical materials for other businesses in an increasingly digital world is not particularly sexy or lucrative. In a 2021 investor presentation, DCM cited an expected annual growth rate for the “conventional print solutions” sector of ~2%/year. Based on a few data series I’ve reviewed, I’d say that’s a pretty generous outlook. Canadian “print related activity” GDP readings were declining ~2%/year before COVID and current levels are down ~25% from pre-COVID levels. As a result, over the course of the last 15 years or so DCM’s EV/EBITDA multiple has largely been anchored in the 4-6x range. Obviously some of that could be attributed to its small size and historical execution issues, but I think the vast majority of such a paltry valuation is attributable to the fact that they operate in what is widely acknowledged as a declining industry (printing). The most directly applicable comparison that I was able to find in public markets (Transcontinental Inc, $TCL in Canada) seems to suffer from similar valuation woes. Other operators in the space, such as RRD’s old printing business and Xerox’s printing operations, seem/seemed to be treated as step children within their larger organizations. Presumably because of their “melting ice cube” outlooks (and their economics aren’t much to write home about, either). I highlight all of this to make the very real & valid point that the landscape is not exactly titillating to less detail-focused investors and might continue to be an overhang on valuation. But I do want to circle back to my point from earlier that they are actively trying to re-define their “TAM” (yuck, hate using that phrase). I continue to believe that if they can prove traction on the software/platform side of the business that will be the true value unlock here.

One key element that you may have noticed missing from this discussion so far has been valuation. I must confess that I have been a shareholder in DCM for over two years now (I am very late on getting this write up published). When I established my initial position in Q3 of 2021 I bought at prices significantly lower than the current market price (although I have added at prices higher than current, too). I think the story was a little simpler then because valuation was pretty low (in the 6 to 8x EV/EBITDA range). Today, current valuations are a bit more aggressive. The acquisition cost are still fresh and causing some noise in the reported metrics but even using DCM’s reported adjusted EBITDA measure, shares are trading around 10x EV/TTM EBITDA today, but is being obscured by expectations of higher profitability as RRD is integrated. Let’s remember that when the RRD deal was announced, the pro-forma entity would reportedly have ~C$500 in combined revenues. We did not, however, get much information on the underlying economics of the RRD operation at the time. I, and probably most reasonable investors, presumed that since it was being carved off and sold by RRD’s P.E. ownership that the business wasn’t exactly humming (and that’s been borne out in the 2 quarters of consolidated financial results since the closing of the transaction). But, if one assumed that DCM’s management team would successfully be able to get RRD’s profitability to roughly similar levels of current DCM operations (let’s say 14% EBITDA margins, as reported for FY 2022) you’d at some point over the next 12-24months have a combined entity producing ~C$70M in EBITDA across a CAN/U.S. footprint with green shoots of software/ARR-products baked in on a <3x EBITDA levered business. So, based on actual results thus far that 10x valuation may seem a little lofty (remember DCM has been stuck in 4-6x range for the last 15 years before the RRD acquisition), but if you think Kellam et al can whip RRD into shape then you’re really looking at a more historically-reasonable 5.5-6x type multiple (C$386M EV on fully synergized/normalized $70M EBITDA). My whole point here is that the market is somewhat baking in the fact that the combined economics will improve beyond what’s currently reflected. And make no mistake when I say “baking in” I mean “expectations” – which can be devastating if not met. Especially for small/micro caps in shrinking industries. For what it’s worth, I added significantly to my position in August of this year, well above current market prices. Obviously DCM has been a win for me already, but I still believe the market is underpricing the optionality of the developing platform business and the ability of the management team to deliver above expectations.

The Key Variables:

- Continued successful integration of the RRD business (looking good so far – per the Q3 they are on track with their 18mo timeline having reduced some headcount and consolidated some facilities while moving anticipated synergies up by ~C$5m/yr)

- This is two pronged: we should see cost synergies as well as revenue increases from new offerings to RRD clients

- Demonstrated traction in the DCM Digital initiatives (this is coming piece-meal from earnings calls as they have not disclosed these in their filings/press releases. ~25% growth YoY in Digital revenue as of Q3 2023 call with targets of >60%)

- Continue progress on debt paydown

- Maybe not as important to some investors, but being that DCM is small and this was quite a bit of debt added to the balance sheet with the RDD acquisition, I would like to see continued progress on the debt paydown to their 1x EBITDA target

Although not totally de-risked, I believe DCM to be an attractive and fairly high quality opportunity in the market right now. Management has demonstrated the will and ability to drive organizational change and now have the opportunity to prove themselves on a larger platform thanks to a transformative acquisition. DCM screens as a boring and somewhat overvalued business but a fundamental assessment of the underlying details will offer patient investors the opportunity for attractive returns.

Assuming DCM can accomplish all of its strategic objectives discussed above and establish itself as more than a simple printing services provider, I see a path to the company doubling its equity valuation on a 5 year time horizon.

As of the writing of this post DCM (held as shares of DCMDF) comprises 10% of my managed portfolio. My average cost basis is USD$1.24.

One thought on “Data Communication Management (DCM/DCMDF) ”